Why Inflation is Rising in China, and in the US

Below is a summary Huatai Securities Economist Eva Yi’s report, Shifting Gears from ‘Reflation’ to ‘Inflation’

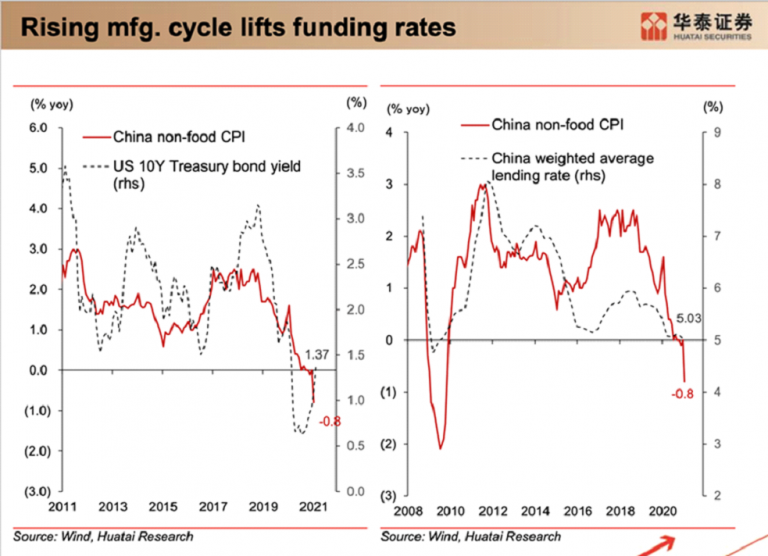

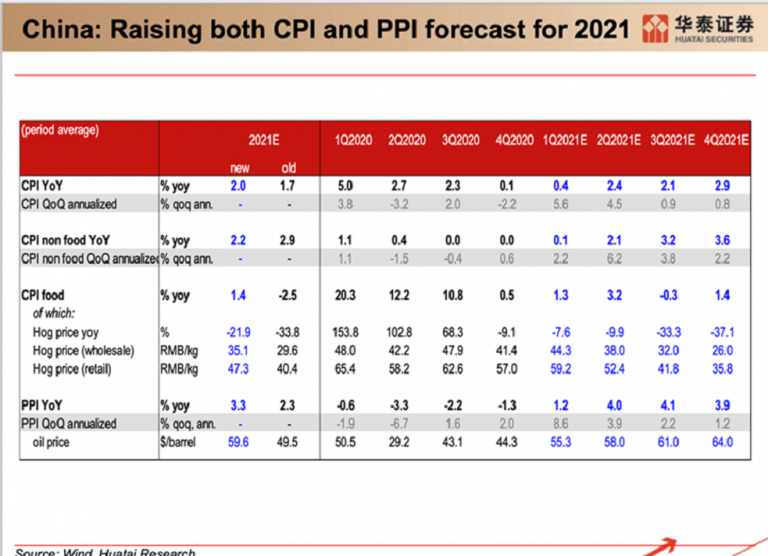

These snapshots strongly suggest a near-term spike in China CPI and PPI and a connection to US and global rates

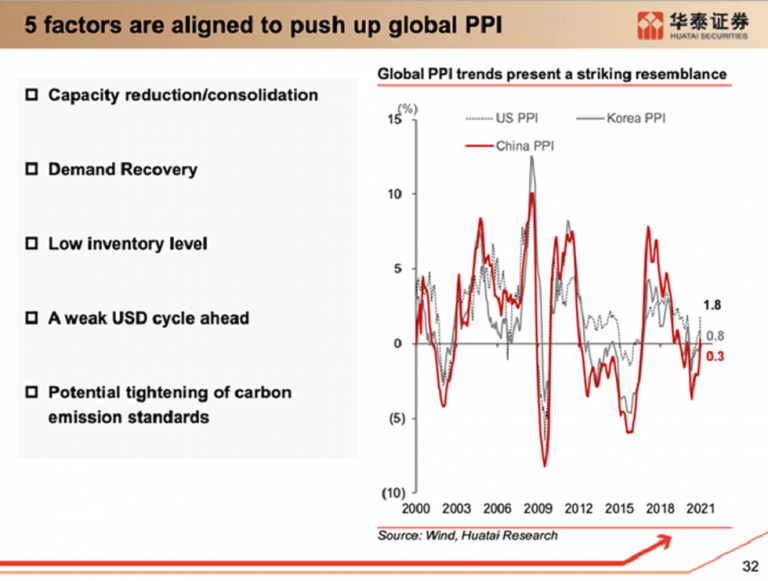

– Five Factors Pushing Up Global PPI – a “Striking Alignment”

THE BACKDROP:

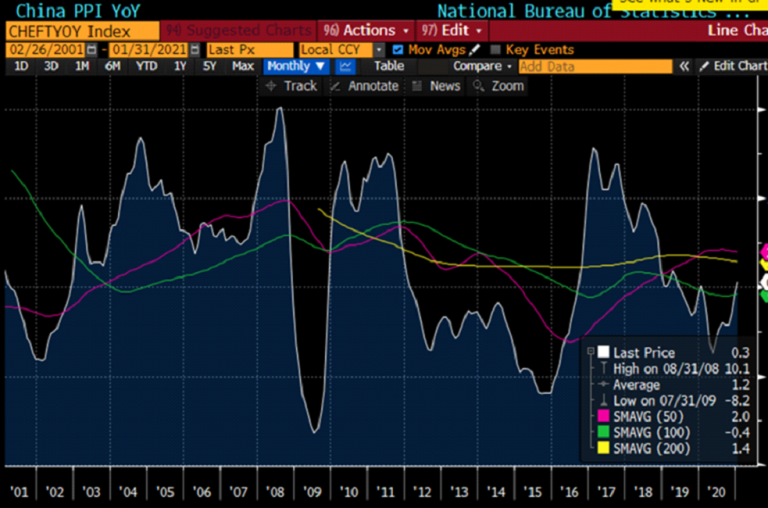

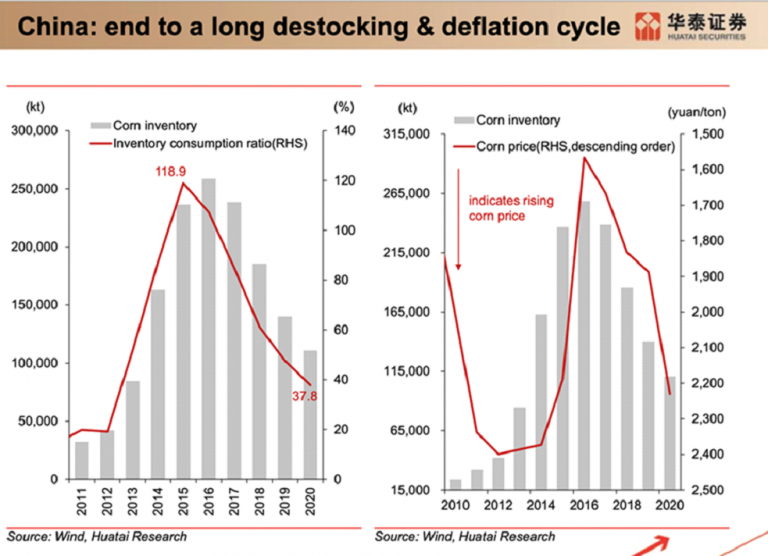

After a 10-year decline in the China CPI and a 4-year decline in the China PPI, the pace of inflation recovery in 9M2021 may surprise investors – China Long Term PPI – A +0.3% reading in January may become a 4% to 5% print in April or May.

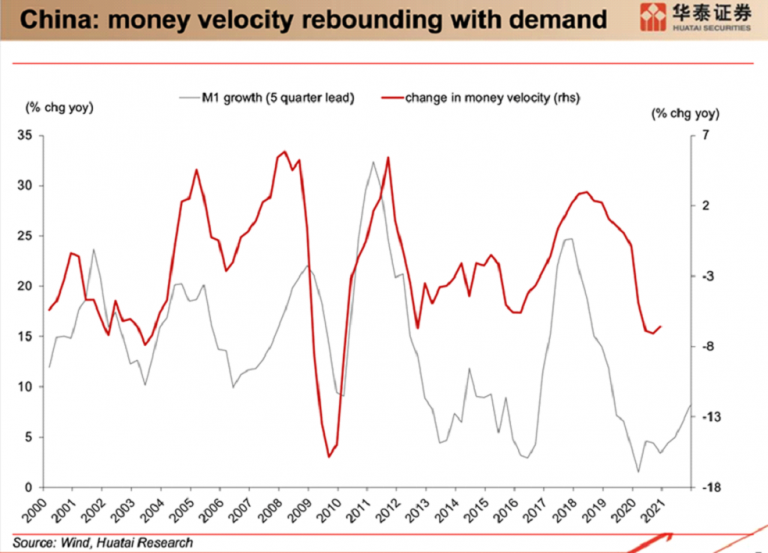

Key China Factors at Work that Raise Inflation and Overall Economic Activity Globally

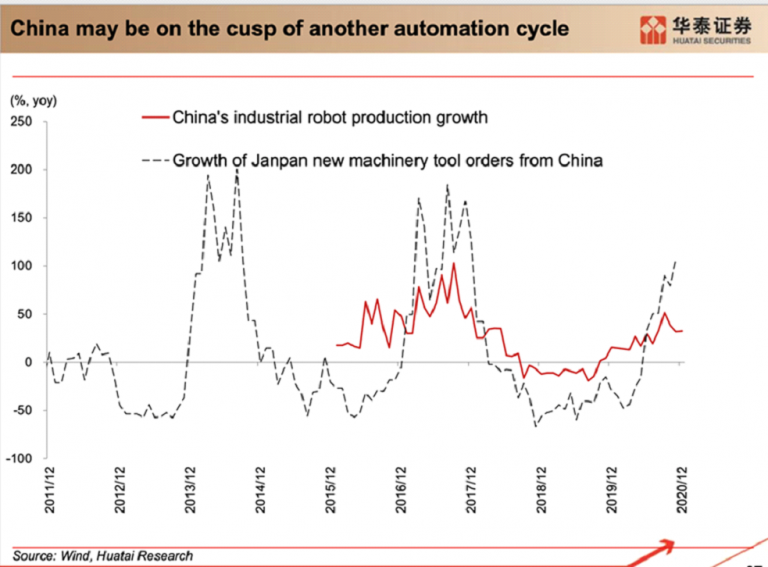

After a 10-year Down Cycle in Manufacturing Investment Growth in China, a Medium-Term Upturn is Now Imminent

Chinese Machine Tool Orders from Japan Drive Chinese Factory Automation Rates

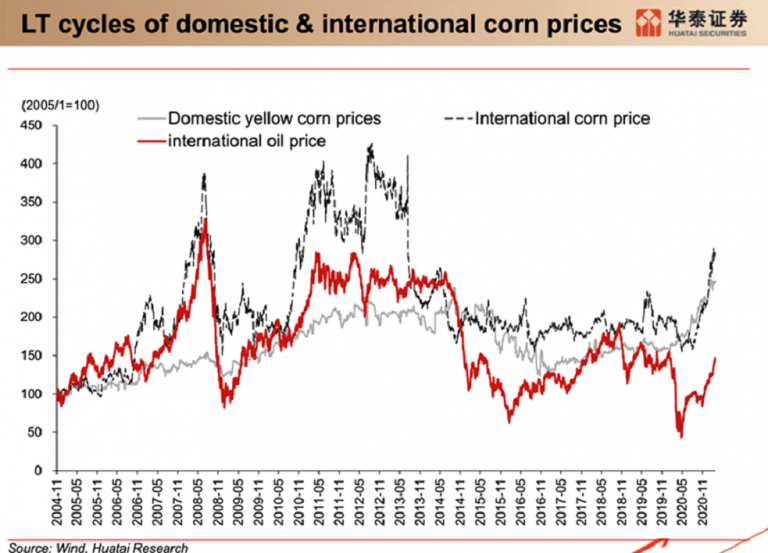

And Other Prices are Pressuring the Global CPI

China consumes 25% of all global corn and 33% of global soybean production

A Relationship to Watch – China ex-Food CPI and US 10 Yr. Treasuries

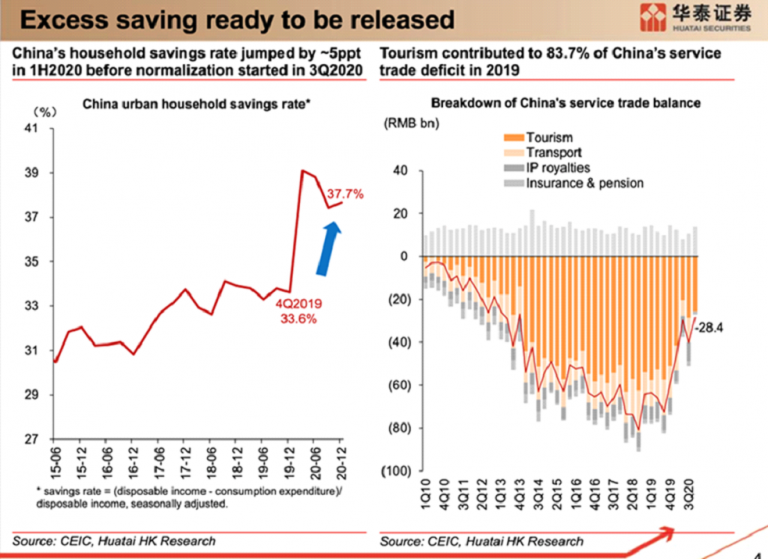

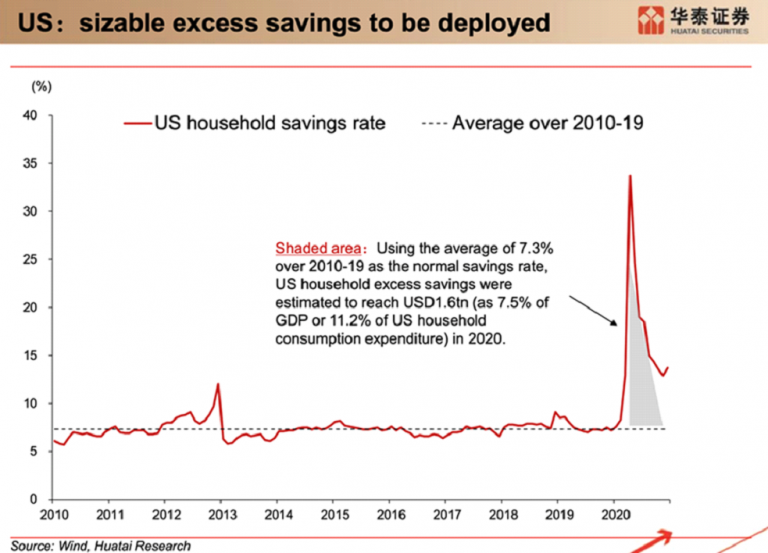

Two Cannons of Excess Savings – Chinese and American Consumers Could Potentially Unleash $1.5 Trillion of Spending When Global Reopening Is At a Nascent Stage

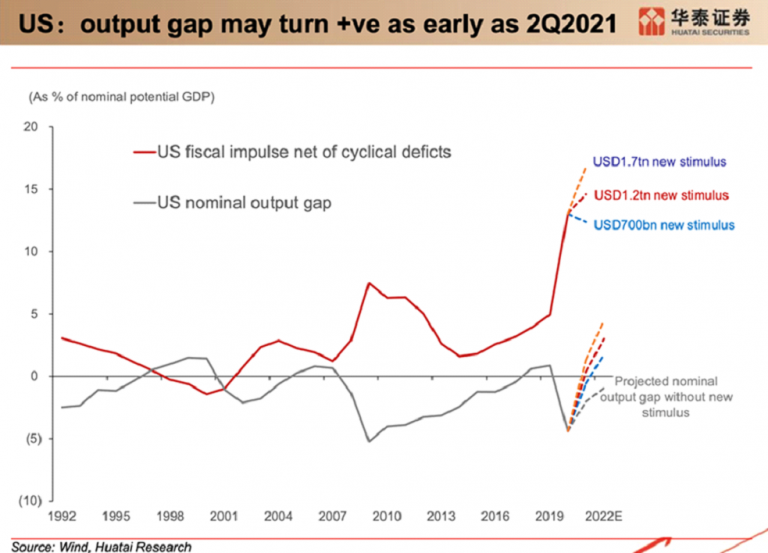

Key Harbinger of Inflation – Huatai Securities Sees the US Set Up For the Largest Output Gap in 20 Years

Huatai Economics Team Looking Closely at the FOREX Markets

While the DXY and CNY are at Sensitive Support Levels

Our Recently Revised Forecasts