China’s Common Prosperity – An Economist’s View

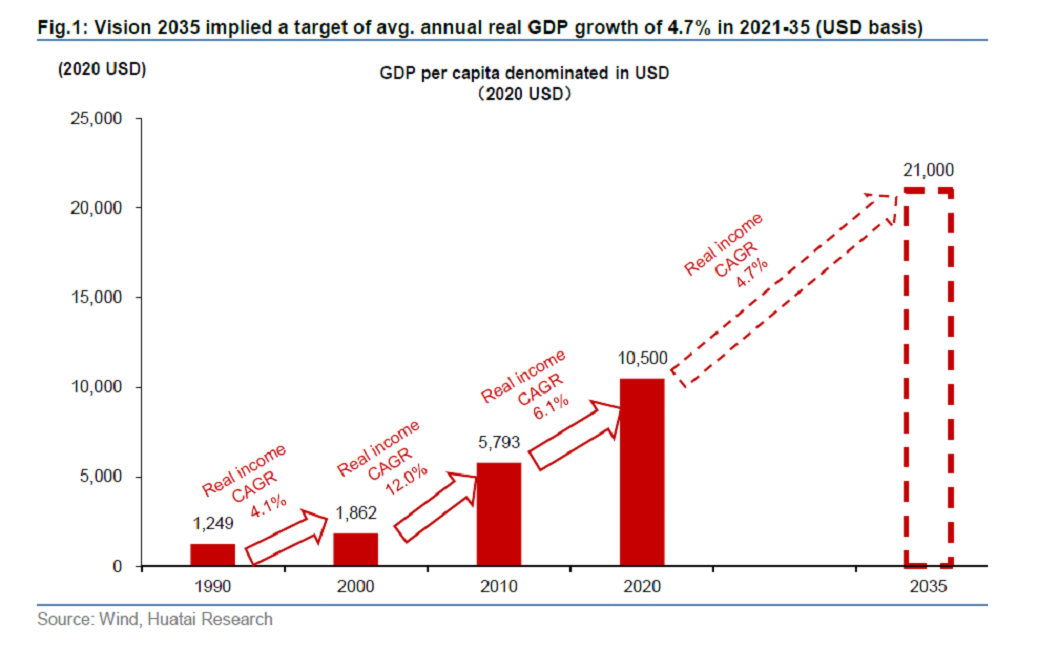

2021 appears to mark a major inflection point in investor views towards China as it embarks on a so-called movement for “Common Prosperity”. Doubling of China’s per capita GDP by 2035 is the single hard metric the government has given for achieving this directive, but investors have taken note of what they see as associated with this “Common Prosperity” campaign and are concerned about its impact on growth and investment returns.

For good reason. Eva YI has published “What Does the Goal of Common Prosperity Entail?” and provides readers both inside and outside China a rational, economics perspective of what China has to do to meet its goals while resolving inherent conflicts. A reader will recognize that Eva is indicating that the most important changes needed are ones that must occur from within government policy itself rather than “rectifying” private enterprise”. Changes indeed have come for the China private sector, as it is coming for global corporations where political leaders are focusing on equality over efficiency, but this China analysis suggests it is government fiscal and monetary policy that needs to be changed the most.

- Details:

- Key Points

- The State of Income Distribution in China

- Redistribution, in Threes – Primary, Secondary, Tertiary

- Real Solutions

Key Points

China needs to aggressively grow the pie much more for much longer before it can start redistributing it. “Growth is the clearest prerequisite to obtaining common prosperity.” China needs to grow the economy at least 5.5% per year on a real basis through 2025 and 4.7% per annum each year through 2035 to meet its goal. This is more daunting than historical numbers suggest.

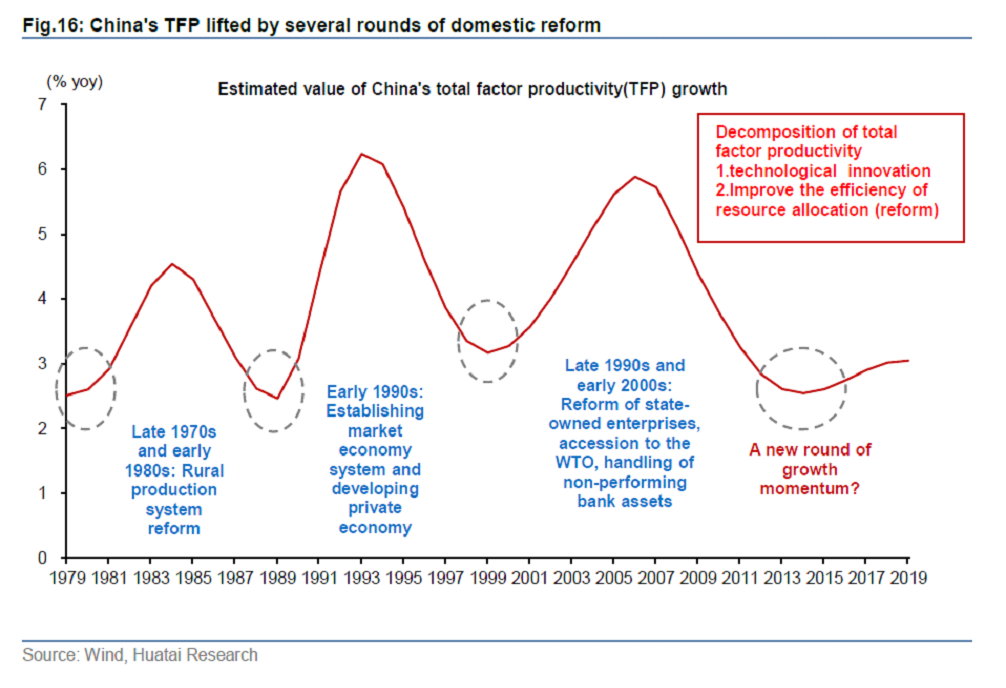

More than anything, China needs to focus on boosting human capital and Total Factor Productivity (TFP) to meet its goals. TFP has slowed down in China from 4.2pp in the years through 2007 to just 2.1pp in the three years ending 2019. Eva shows that China relies on returns on capital stock (k) rather than on returns on labor (l), and with no change, this trend is “unfavorable for achieving common prosperity”.

But big change is needed. Given China’s demographic challenge, large upgrades in China’s labor quality need to drive TFP higher. China will experience a net loss of c. 62 million people in the labor force by 2030 (8% of total), so raising the current retirement age (60 for men, 50 for women) very soon to developed market retirement ages is critical. Given that life expectancy in China is similar to developed economies, this is reasonable, but there is no clarity on when an official retirement age change may be enacted.

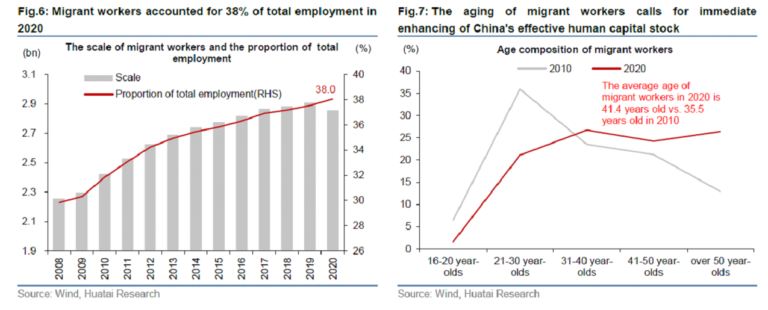

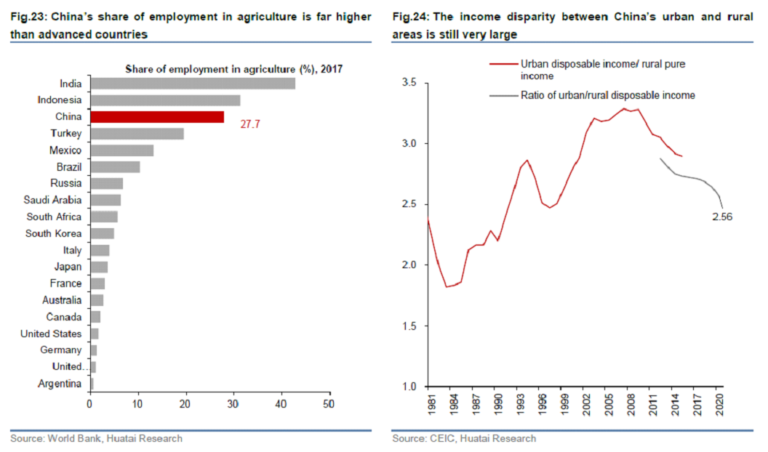

Hukou reform is particularly urgent now and critical given that 38% of the China labor force is still migrant workers. This huge part of the workforce has limited ability to accumulate skilled capital. And national laws require them to return to their home province at age 45 when some workers are at their peak of productivity. Enabling increased urbanization through Hukou reform is critical to begin the process of valuing-up a huge portion of the labor force.

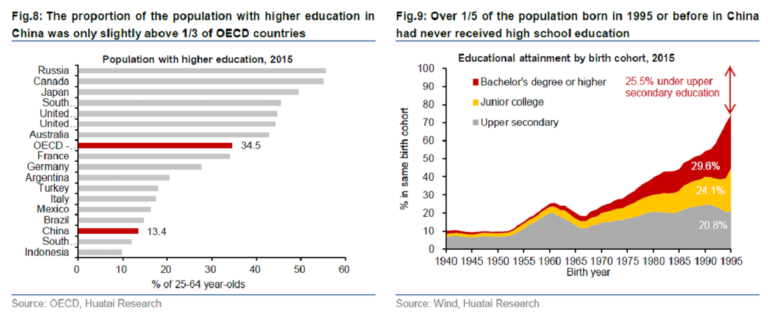

Education levels must be improved – in contrast with the focus on reforming private educational spending, raising the aggregate level of education of the entire population critical. Only 13% of China’s population has more than a high school education, and only 20% of Chinese older than age 25 have graduated from high school. Vocational school training for adults will be critical for China.

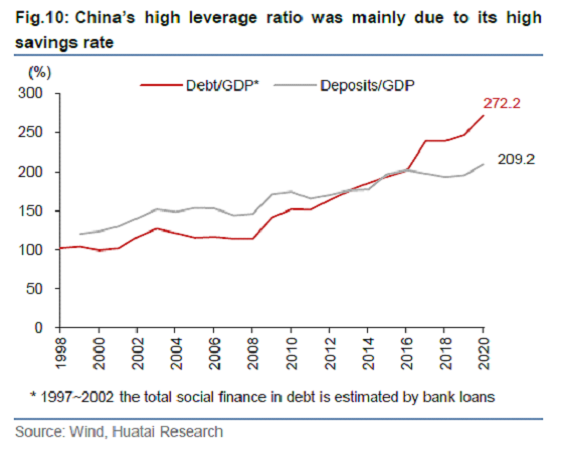

Reforms on the financial sector currently seem to be focused on the banking sector and its associations with real estate and private transactions, but as Eva points out on page 9 and 10, excess savings, excess LGFV borrowing (borrowings by regional and local governments), and lack of equity stakes in projects that improve incentives is what is inefficient.

The State of Income Distribution in China

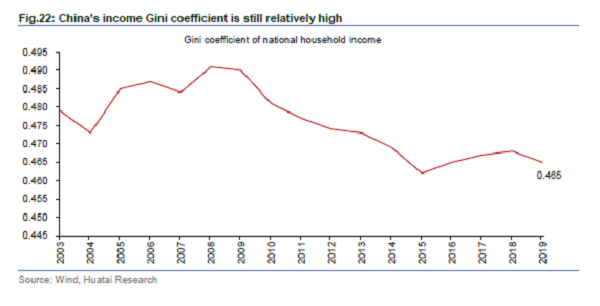

China’s current income Gini coefficient of 0.465 is significantly higher than that of the US (c. 0.41, 2019), Germany (c. 0.32, 2016) and Japan (c. 0.32, 2013). The higher the rating, the more income inequality exists.

Analysis using the Gini Coefficient shows that China has higher income disparity than other nations. Key structural differences account for that. For example, 27% of China’s labor force is still working in agriculture, a predominantly lower income industry, and this is a very large percent relative to developed market economies.

Real estate drives the Inequality – Given high savings rates and lack of asset investment choices, the over-investment into real estate assets has dramatically contributed to income disparity. The average annual real growth rate of property for households as an asset was 17% p.a. between 2002 to 2013. During the same period, the 10% of the population with the least property saw their share of property decrease from 1% to 0.3%, while the 10% of the population with the most property saw their share of property rose from 37% to 48%.

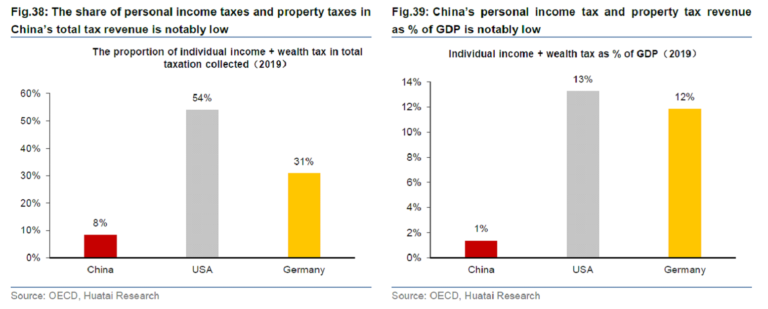

To make real estate less attractive as an investment vehicle and to improve income disparities, initiating a system of property taxes is considered a high priority by the central government. Looking at China’s sources of taxation vs. other countries, big changes need to be implemented.

Redistribution, in Threes – Primary, Secondary, Tertiary

Understanding China’s methodology for taxation

Primary – Primary redistribution refers to changes driven by the market to raise labor income as a percent of income. Hukou reform to drive urbanization and better wages is critical. Promoting Industries with higher labor and knowledge intensity is needed as well. On the other hand, China also is increasingly concerned the past year with curbing the growth of industries that tend to generate monopoly profits – finance, real estate, internet, and data-intensive sectors. This is increasingly an emphasis by policymakers outside of China as well, putting some of the profits of the most important industries at risk.

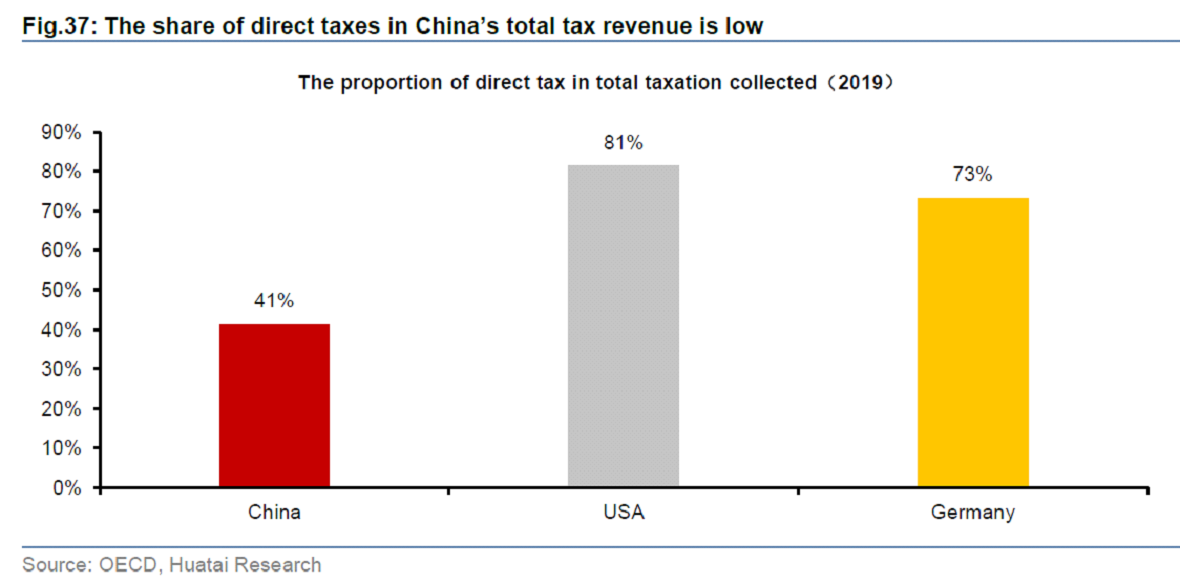

Secondary – Secondary redistribution refers to government policies to redistribute income – mainly through taxes and social services. China’s tax system of central government and local taxes and direct and indirect taxes look like the rest of the world on the surface, but there are major differences.

Direct taxes are only 41% of tax revenue vs. 81% in the US. In China, personal and property tax revenue combined account for only 1% of China’s GDP, lagging far behind the US (13%) and Germany (12%). At the same time, Chinese urban households’ assets and liabilities shows that real property accounts for nearly 70% of the total assets. This is highly unbalanced.

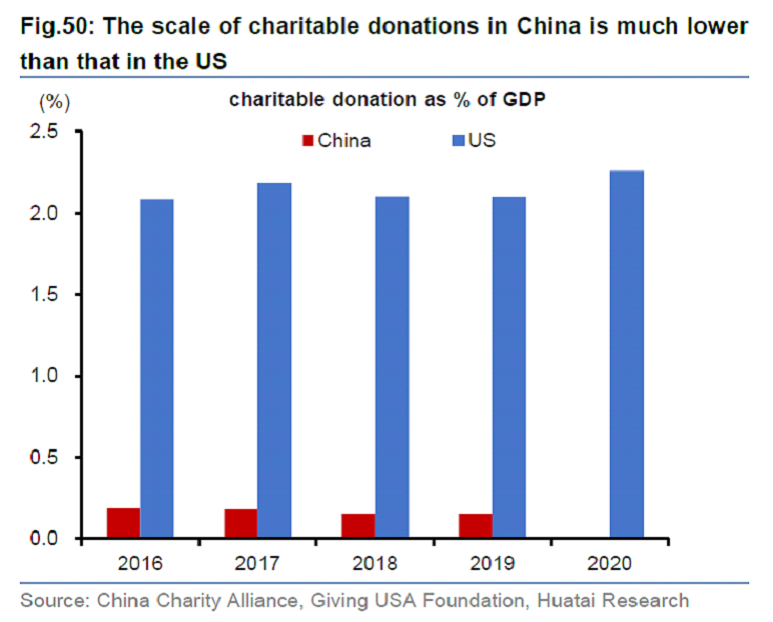

Tertiary – Tertiary redistribution refers to voluntary & charitable contributions. The scale of charitable donations in China is much lower than that in the US. In 2019, the proportion of total charitable donations in the US to GDP was nearly 14x that of China, and the proportion of per capita donations to per capita disposable income was nearly 8x that of China.

As an emerging market, these numbers are not a surprise. But as China matures and develops, it needs to establish a system to encourage the development of philanthropy, including encouraging and simplifying the establishment of charitable institutions, ramping up preferential tax policies, and introducing support policies in finance, land, education, and charitable trusts.

Solutions to Income Inequality and Achieving “Common Prosperity”

- Primary Solutions include accelerating urbanization and Hukou reform are the most important in Huatai’s view. In tandem with this, raising the living standards of tier three and four cities and rural areas by increasing access to education & healthcare services is also necessary. Then, policies that upgrade China’s industrial infrastructure and raise R&D / high tech investments will be next most critical. Still, other government policies will be promoted. For example, policies to advance the birth rate are already being implemented, but Eva sees scant evidence this will be successful.

China will continues to promote “enhanced financial reforms” to root out corruption in both the government and private sector – this may be necessary as long as it does not adversely impact capital allocation which is a risk. Overall, breaking up monopolies and unfair competition will continue to be a mainstay of central government policies.

- Secondary Solutions which focus on tax policy and allocation of government services is where the most change may occur. Raising the share of direct taxes will be happening, perhaps within the next year. This will first appear as property taxes, and Eva understands this is the tax that has the clearest consensus within the government.

Regions such as Shanghai and Chongqing have been piloting test property tax programs since 2011. Given the intense focus of the government to reduce speculation in real estate, increasing the tax burden on multiple homeowners seems quite likely. Eva thinks “conditions are quite ripe”. Note Income taxes may rise over time, but given China’s status as an emerging market, they should only rise very marginally. Eva discusses the outlook for capital gains taxes, inheritance, and gift taxes, among others.

For full details, the Huatai Economics team’s 37-page report, “What Does the Goal of Common Prosperity Entail?” can be found for registered users on the Huatai Research Portal: https://intl.inst.htsc.com, or please contact Patrick Springer, head of institutional securities, at PatrickLSpringer@htsc-us.com.