Huatai Securities (USA) CEO proudly presented our parent company Huatai Securities' China retail brokerage business at this inaugural Nasdaq global event and shared his views as a panelist on "Harnessing the Brand to Drive Growth".

Congratulations to Haidilao on its successful debut in the US capital markets.

Economics — New Consumption Patterns in China – A Top-Down Approach

China’s Clean Energy Reset – a New Decade of Investments

China’s Updated Targets for Clean Energy is a major investment thematic for Energy-investors, ESG Implementers, and importantly for Inflation-watchers. The size and scale of China’s top-down plans are immense, and on the ground, there is a whole ecosystem of investment activities for global investors to focus on.

- While more than 150 Paris Agreement signatories were scheduled to update their new energy/carbon neutral plans by year-end 2020, it is the size and scale of China’s updated plans that really matter to global investors.Amidst the topical discussions about the “Great Reset” climate thematic, investors need to pay attention to what China is planning.

- China already has a globally dominant position in the renewables space, and their track record for investing and expanding power capacity is difficult to challenge. China’s history of power capacity implementation suggests we must pay attention to their current plans to dramatically expand renewables.

Huatai’s new 33-page thematic report, “New Energy Sector to Rise on the ‘Great Reset’”, and its bottoms-up companion piece, “Energy Reform Accelerates: 2021 Power Equipment and New Energy Outlook”, each by senior analyst Bill Huang and the Huatai Renewablesand Power Equipment team, combines a top-down and bottoms-up analysis of China’s expanding NEV battery& vehicle market, Solar/Photovoltaic Cells, and Wind Generation markets. In our “Great Reset” report, we also outline the growing New Energy ETF space in China with analysis performed by our head of quant research, Xiaoming Lin.

- Executive Summary Overview

- I. Quick Review –China’s size and scale in the renewables and total energy market / China’s record-breaking power generation expansion over the past twenty years.

- II. China’s Updated New Energy Plans –Massive Expansion

- III. Why is China doing this and how will it be done?

- IV. New Energy Vehicles –China Domestic market 40% of global market in 2022

- V. New Energy Batteries & Materials –Ecosystem Opportunity

- VI. Solar –Dominant Global Market Share across the Photovoltaic chain

- VII. Wind Power –Achieving Grid Parity in 2021, 50-60GW expansion per year

I. QUICK REVIEW–CHINA’S ENERGY SIZE AND SCALE; HISTORIC CAPACITY EXPANSION

China is not just the world’s largest energy consumer, but also the globe’s largest Energy producer.

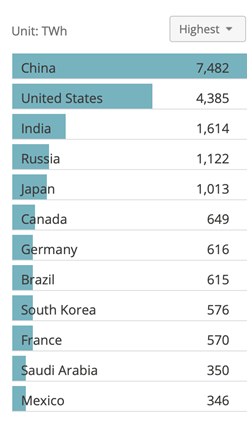

The World’s Largest Power Generation Producers, TWh, 2019

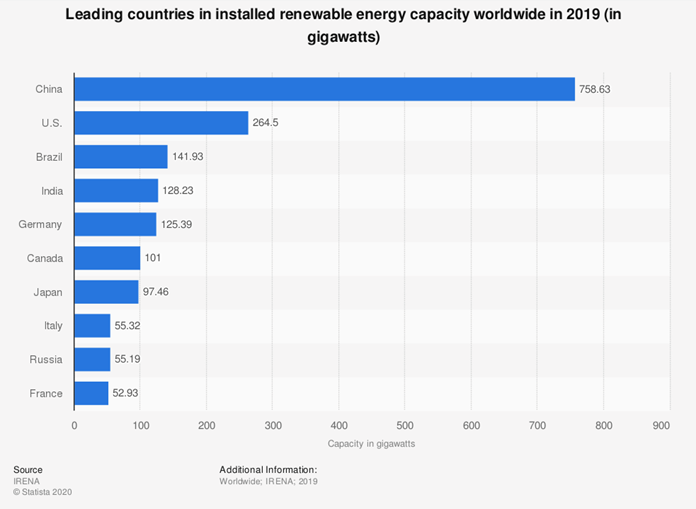

China is also the largest producer of renewable energy globally at nearly 3x the US

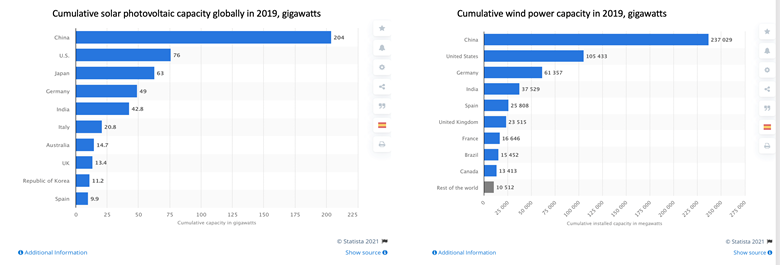

In terms of production of Renewables, China leads globally in Solar & Wind Capacity:

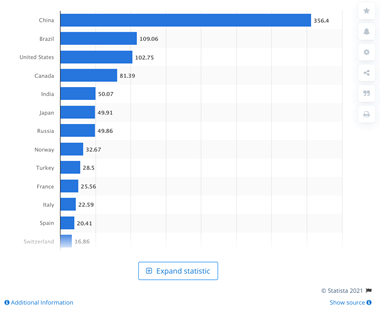

And in Hydropower as well.

Cumulative Hydropower Capacity in 2019, gigawatts

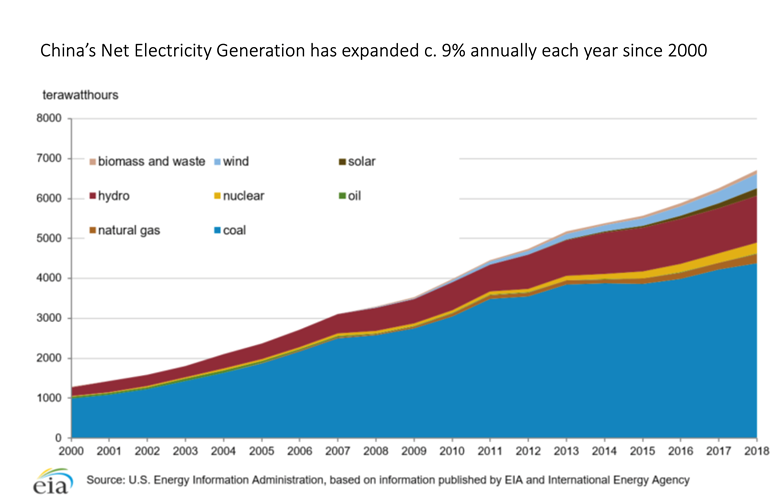

While investors may be rightfully wary about any given country’s energy and ecological commitments, China has a track record for aggressively expanding capacity to support its economy –

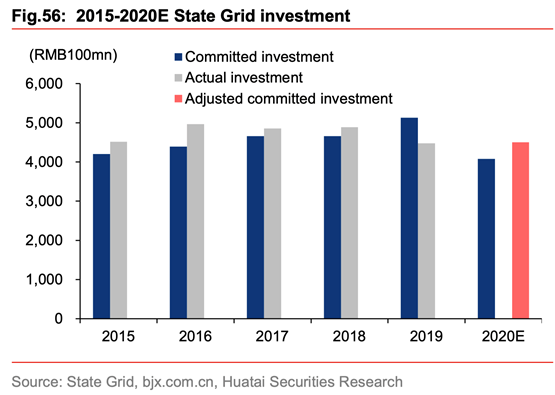

Aside from its massive grid creation between 2000 and 2010, China has invested approximately $350 Billion in upgrading its power grid between 2015-2020 alone

II. CHINA’S UPDATED NEW ENERGY PLANS – MASSIVE EXPANSION

China announced in October 2020 that it plans for its carbon emissions to peak in 2030 with total non-fossil fuels becoming 25% of total energy consumed. This implies reducing carbon intensity by 65% using 2005 as a baseline. They further announced the goal to achieve net carbon neutrality by 2060.

Despite its investments to date in solar and wind power, on a current base of about 415 GWh of solar and wind capacity, achieving China’s 2030 targets implies China will have to invest in another 800 GW of capacity in the next 9 years.

III. WHY IS CHINA DOING THIS AND HOW WILL IT BE DONE?

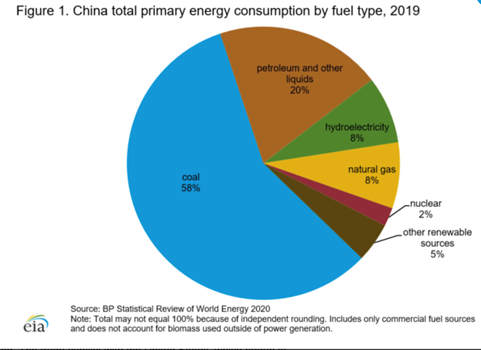

The rationale for these stated plans is important, and the potential impact of these goals are immense. For China, traditional energy supplies are not adequate to meet energy demand, and China’s self sufficiency ratio is declining as it imports more oil and gas, most recently at growth rates of 9.5% YOY and 6.9% YOY, respectively. Overall, 85% of China’s power needs are still reliant on fossil fuels.

China’s degree of dependency for oil and gas is 40% of total, and against the background of a complex international situation and fierce energy competition, China is determined to massively increase its self sufficiency ratio.

Given China’s leadership in key business areas of new energy sectors, surely achieving these global reforms will also enhance China’s international energy influence and business opportunities as well. Bill Huang notes that Europe and China signed the “EU-China Comprehensive Agreement on Investment”, the first foreign investment liberalization agreement that Europe has signed in more than ten years. With it, the EU indicated they may open up market access for power and new energy sectors which Chinese companies would like to target.

Batteries, Solar and Wind Capacity Expansions

Battery investment continues to accelerate and China has leading positions across an eco-system of companies for battery and battery material manufacturing. In solar, China’s total on the ground capacity is expected to double within 5 years, with 2021 alone adding 50GW on a base of c.220GW. Given global industry market shares, China’s PV companies in our universe have significant overseas expansion opportunities. And in wind, China announced a commitment in October 2020 to expand capacity annually by 50GWh through 2025, and then 60 GWh annually through 2030 (2020 Wind base of c. 210GW). Like solar, China is approaching grid parity this year, and offshore wind capacity is ramping.

China Wind Grid Parity

IV. NEW ENERGY VEHICLES – CHINA DOMESTIC MARKET 40% OF GLOBAL MARKET IN 2022

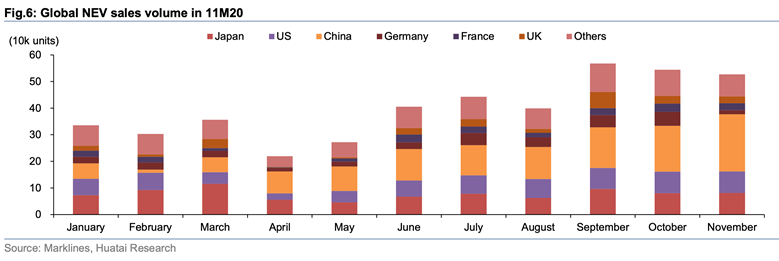

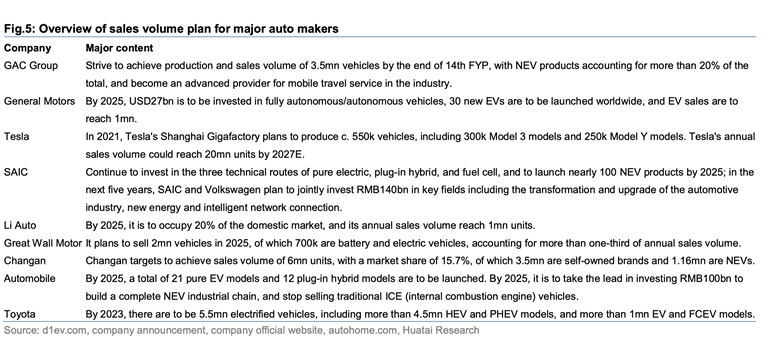

Sales of EVs in China came in at 1.36 million units in 2020 with a pure EV/hybrid mix of 81%/19%. Based on an industry target of 20% penetration of NEVs by 2025, Huatai estimates that will be at least 5.8 million NEV vehicles sold that year.

According to Bill Huang’s model, we expect the global EV market in 2022 to be 5.5 million units, with 39% of those units sold in China.

V. NEW ENERGY BATTERIES & MATERIALS – ECOSYSTEM OPPORTUNITY

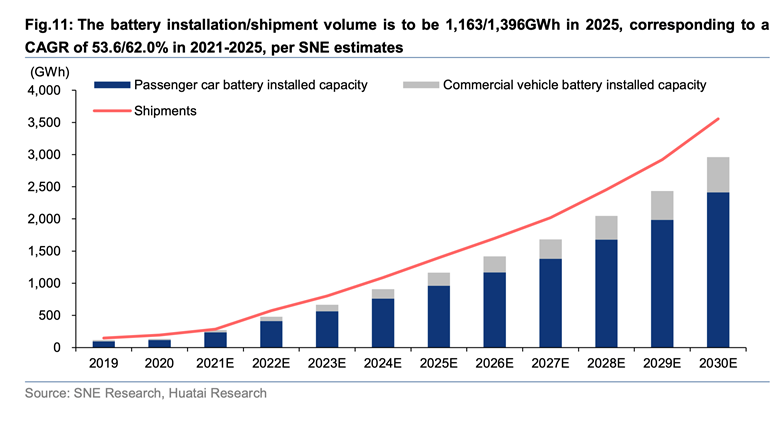

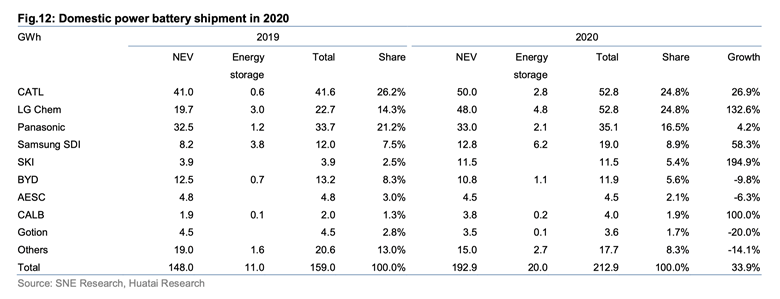

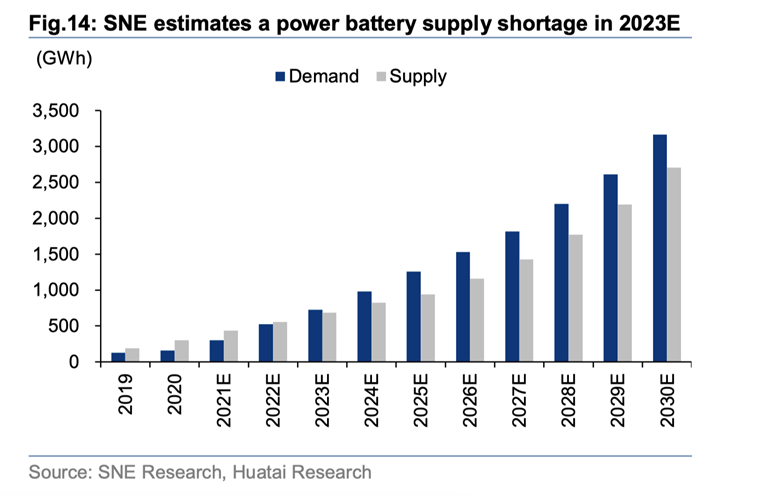

Global battery shipment volume should expand the next 5 years from a base of 213GWh at a 57% CAGR or to c. 1400GW of shipments. One Chinese company is the world’s largest maker of NEV batteries, and a South Korean company has the second largest share.

For Battery Materials in China, we see investment verticals in Lithium-Ion Materials, Separators, both Cathode & Electrode Materials, and Electrolytes which are all experiencing increasing demand.

VI. SOLAR – CHINA COMPANIES HAVE A DOMINANT GLOBAL MARKET SHARE ACROSS THE PHOTOVOLTAIC CHAIN

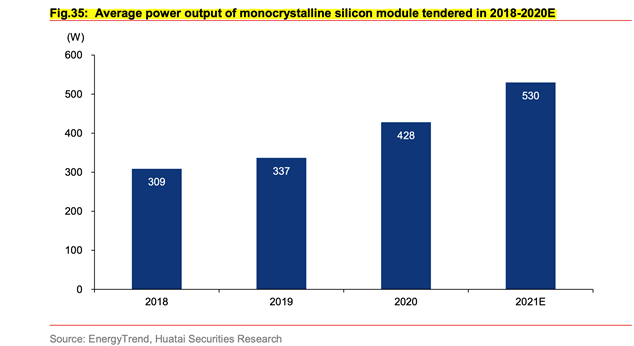

The China Photovoltaic Industry Association (CPIA) expects China’s domestic installed capacity of solar cells (c. 240GW) to double by 2025. Production expansion of large-size silicon wafers, the rise of PERC+ and heterojunction cell technologies have promoted the increase in power generation efficiency and opened the era of grid parity connection of solar power which will be achieved in 2021. And driven by continued cost reductions across all segments of the industry chain, Huatai expects higher profitability for the PV industry. With government subsidies ending by next year, there is an installation rush in 2021.

China dominates the global market across all PV products an PV Equipment.

As of 2019 full year data, China PV suppliers had a market share of

Silicon Materials: 69%

Silicon Wafers: 93.7%

PV Cells: 77.7%

PV Modules: 69.2%

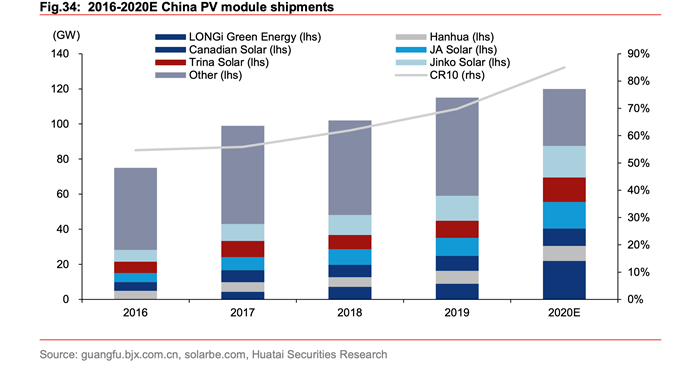

Huatai expects PV Modules to be the biggest market battle in 2021. The top ten players have 70% of the industry’s share. Modules based on large-size silicon wafers (c.f Tianjin Semiconductor) will be used to create next generation 500W modules. The market share of 166mn modules is rapidly increasing and we expect large -size products such as 182mm/210mm modules to see market share gradually pick up in bids in 2021E.

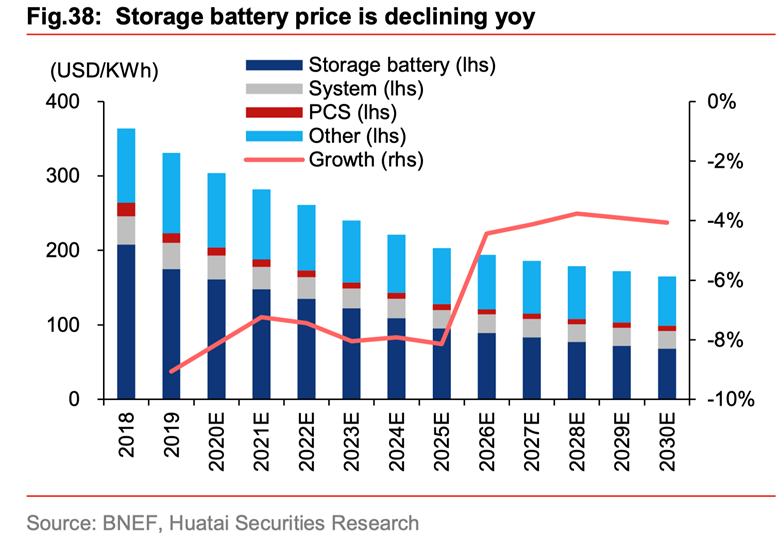

“PV + energy storage” parity brings medium – to long-term development potential, energy storage the next growth driver. Huatai believes that “PV + energy storage” could overcome medium- to long-term development obstacles for new energy. With energy storage costs trending down, the 14th FYP period could in our view be a golden age for energy storage development. Our recommendations are value chain players Sungrow Power and Linyang Energy.